No, we are not ‘halfway through the year’ in July5 min read

It is often said around July and August that we’re more than halfway through the year, and a humanitarian sector or response plan is only funded by a small amount. Here’s a link to the Protection Cluster saying that, ‘as of mid-2022, only 28% of activities have been funded’. Or how about the oPt HRP only being funded 15% as of mid-May 2023. Or OCHA Afghanistan saying that their HRP is only 40% funded more than halfway through the year.

To be generous, this is not the whole story. To be less generous, one might say this is misleading.

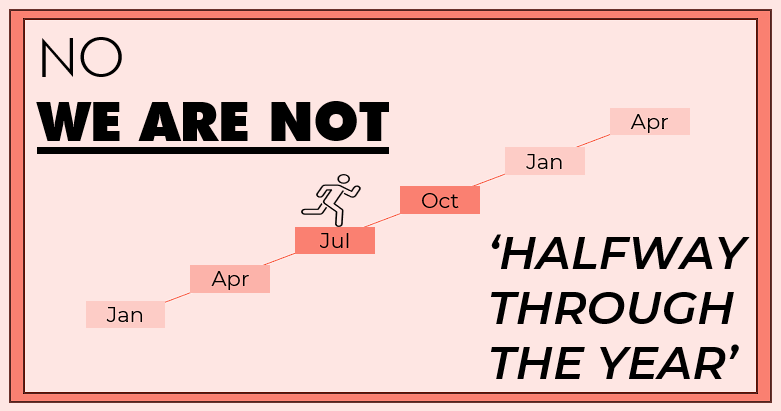

No, we are not ‘halfway through the year’ in July

The ‘UN Relief Chief’, Martin Griffiths, said in a recent press briefing that “Syria is 12 per cent funded in terms of its Humanitarian Response Plan halfway through the year. It’s a deeply, deeply shocking situation”. We agree – this is a shocking situation.

Take a look at the status of the humanitarian sectors in July 2023. Halfway through the year and not one sector is halfway to meeting its funding requirement. In fact, only two sectors (Coordination, and Mine Action) have surpassed 25% of their funding requirement.

Additionally, the graph above does not show the actual dollar value that sectors need. For example, the Food Security sector still needed $17bn (as of 7th July 2023), and Health still needed $4bn.

Such points are great if you work in advocacy and want to make the point to donors that you need funding for your sector, for your response plan, for your organisation.

However, there is an inconvenient truth.

Below we can see how funding to humanitarian sectors evolved across the course of the year for response plans in 2022. Readers will be familiar with Q1 to Q4. Q0 means funding already showing as being received for response plans in 2022, but before 2022, and Q5 and Q6 mean funding received in January to March, and April to June, the year after (but still logged to the 2022 response plans and sectors.

On average, out of all the funding that sectors received for 2022, only 26% was registered online by July 2022, i.e. ‘halfway through the year’. Indeed, some sectors received quite a bit more funding for 2022, but this actually only showed up on FTS in 2023, such as Child Protection, GBV and Protection.

This is why it is misleading to say we are ‘halfway through the year’. In fact, by July, we are only a quarter of the way through the year if we think about when funding actually starts to show in the system

Sidenote: we only have this data for sectors, and not specific response plans, as a result of how we extract data. This is unfortunate, but we will try to update this story with response plan data if we manage to dig up old data files. We think it will tell the same story.

Positive signs for humanitarian sectors for 2023

With this knowledge, we are able to update our forecasts for humanitarian sectors in 2023 with a greater understanding of the data we rely on to make the forecasts.

All sectors, except Food Security and Logistics, are forecast to grow in absolute dollar terms in 2023. This is still early days in the financial year, so we need to take these forecasts with a pinch of salt. However, there are substantial forecasted uplifts amongst specific sectors, such as Shelter (forecasted a 40% bump), Child Protection (51%), Early Recovery (105%), and GBV (38%). Food Security is not shown above, but is currently forecast to decline very marginally by 1%.

However, we are talking in absolute dollar terms here. We also need to take into account how much funding is needed to put this anticipated growth into context. If the funding requirement grows faster than funding received, then this is not progress for the sector, no matter the uplift in dollar terms. Go to the sector pages to find out more on individual sectors on this.

Why the forecasted uplift in 2023 for humanitarian funding?

This is partly due to the fact that all but one sector had received more funding by the end of June 2023, than they had by the end of June 2022.

Six sectors had received more than double what they had at the same point last year: Early Recovery, Shelter and NFI, Protection, Child Protection, Mine Action, and CCCM. And another three sectors were ahead of their 2022 value by more than 40%: WASH, Emergency Telecommunications, and Nutrition.

The increases in actual funding by this point in the year then feed into our forecasting model, thus contributing in part to our forecasted uplift amongst most sectors in humanitarian funding.

So why has there been an uplift in actual funding halfway through the calendar year?

Below, we have examined six sectors with substantial uplifts in funding in 2023 (so far) – red is uplift in funding, and green is the amount received this time last year for 2022 response plans.

An uplift in funding from the Government of the United States is a significant factor behind this dynamic. Whilst it varies from sector-to-sector, there is no doubt that a significant extra amount of US funding has come online by ‘halfway through the year’ when compared to last year. Across these six selected sectors, $720m of extra US funding has been received, compared to funding received from the US at the same point last year.

We cannot rule out the possibility that this is just ‘noise’ and normal year-on-year variation in when data is logged into the system. However, the extra US funding halfway through the calendar year does mirror broader trends in increases in humanitarian funding from the US ($6.7bn in 2019 vs. $14.2bn in 2022)

Of course, it should also be said that other donors have also contributed to the uplift in funding, and the uplift is by no means all down to the Government of the United States.

Methodology and Sources

Head over to our Forecast Methodology page for more technical information on how our forecasts work.

For sources, please refer to the credits on the individual graphs above.