🚨 NEW: Updated Q1 April 2022 Forecasts3 min read

Welcome to the first update of our 2022 funding forecasts. This is our Q1 forecast (called Q1 as it follows the end of the first quarter, i.e. end of March). It takes into account our initial Q0 forecast which feeds in historic data, and the most recent data on how things are going in the current year (which is particularly interesting in this story). The sector pages will be updated in the coming weeks to reflect the forecast revisions.

We’ve revised our forecasts up

The biggest change in our forecasts is that we have revised up nearly all sectors (except Coordination and Support Services). Most of these revisions are by a small amount (between 1% and 10% increases). But a number of sectors have been revised up substantially, with Early Recovery leading the way with a 27% upwards revision, followed by Shelter (18%), Mine Action (15%), and Protection, WASH, and CCCM (all 13% upwards revisions).

The question is: why have so many sectors been revised up? There are a couple of possible avenues to explore.

Firstly, one of our main inputs into our model is funding received last year. Could it be that funding for 2021 actually increased in the last few months to such a significant extent that it pushed up this year’s forecast? Remember – quite a bit of funding is logged after the year end. The short answer is: no. In fact, we had to revise down our 2021 estimates as not as much funding was logged after year end as we had thought. So this avenue is a dead end.

Secondly, could it be that significantly more funding had been logged in the first few months of the year, thus pushing up our forecasts? Yes. Consider the below graph.

By the end of March, it’s quite normal for funding to response plans to be around the $800m to $1.2bn range. But this year, humanitarian response plans had received twice as much as they did at the same point last year.

So let’s delve deeper.

What’s behind the doubling of funding at this point in the year?

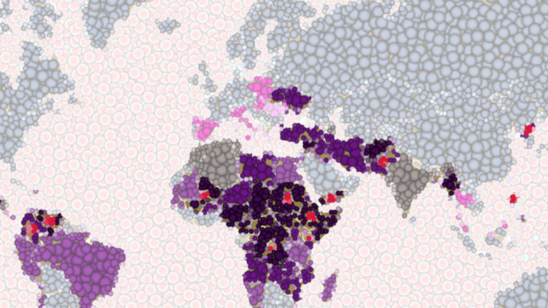

To answer this question we need to look at where the funding is going. Afghanistan and Ukraine (flash appeal and refugee appeal) have received the majority of funding so far this year. Together, these three response plans have received $1.4bn – far more than every other humanitarian plan combined (and there’s 36 other response plans in that bucket).

This is understandable given the circumstances. Yet, the inequity is still striking. As money is (quite rightly) poured into Afghanistan and Ukraine, and neighbouring countries to Ukraine, there are still 10 response plans that haven’t received $10m yet in 2022.

Returning to our forecast, this massive uplift in funding in Q1 means that our forecast assumes that such an uplift carries on throughout the year. And so the assumption in our model raises a vital question: does this extra funding in Q1 mean that funding across the whole year will increase, or have we just front-loaded funding to specific crises given the immediacy of those crises. Is the pie actually getting bigger, or are we just reallocating the slices?

Reporting on this issue by The New Humanitarian points to an unclear picture. Some donors insist this is additional funding that won’t be diverted from elsewhere, whilst many agencies are reporting the effects of diversion already.

So where does that leave our forecasts for 2022?

Even with the increase in forecasts for most sectors, only 2 sectors have a possibility of reaching 50% of their funding requirement. Most sectors are within touching distance of 25% of their requirement, but given the amount of funding that is required for the plethora of humanitarian crises, this is still not a good position for humanitarian sectors to be in.

Methodology and Sources

Head over to our Forecast Methodology page for more technical information on how our forecasts work.