🚨 NEW: Updated Q2 July 2022 Forecasts3 min read

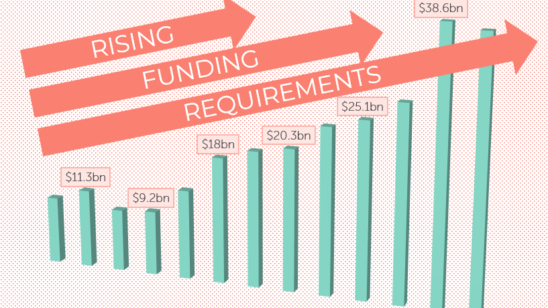

Latest analysis by Humanitarian Funding Forecasts shows that most humanitarian sectors in 2022 are forecast to grow more than what we thought at the start of the year.

Of the 15 sectors analysed, 9 are forecast to grow more compared to our initial forecasts, 4 sectors have had their forecasts revised down, and another 2 are relatively stagnant.

Many sectors are ahead of where they were last year at the same point, and this is driving the higher revision forecasts for 2022.

However the key question is: are these forecasts correct and reflection of higher funding in general, or do they reflect funding brought forward for specific crises, for example, Ukraine?

Moving on up now

More than half of the sectors that we produce forecasts for have had their forecasts revised up, compared to our initial forecasts. These sectors have had their central estimate revised upward by more than 9%, including Coordination, Food Security, Education, and Health which have all seen their forecasts revised up by more than 20%.

At the other end of the spectrum, four sectors have had their central estimate revised down. These are: Emergency Telecommunications, GBV, Early Recovery, and Child Protection.

Interestingly, the sectors with upward revisions tend to be the larger humanitarian sectors, and those with downward revisions tend to be smaller sectors.

New year, more funding

Every sector (except one) has received more funding at this point in 2022 than at the same point in 2021. This includes 5 sectors that have received more than double the same point last year (Mine Action, Emergency Telecommunications, Coordination, Camp Coordination/Management, and Health).

There are two possibilities why funding this year is so much higher by the end of June. The first possibility is that this reflects more funding going to the sector in general, and this will be reflected in the end of year figures. More money due to higher needs. Sounds too good to be true, though.

The second possibility is that funding is higher by mid-year as donors have “front-loaded” 2022 financing due to the war in Ukraine and other emergencies. In reality that would mean the pot of money is the same as it was at the start of the year, it’s just a matter of when and where it is allocated that’s changed.

So let’s look at where it has been allocated.

Consolidation

Three crises (or five response plans) have received over 50% of the funding in 2022. Unsurprisingly this includes Ukraine and Afghanistan, as well as Syria. Yemen has also received over 10% of global funding.

Compare this to funding for the whole of 2021, however, and you can see how funding was more evenly spread across a wider range of response plans.

Whilst only 8 response plans are getting 80% of the funding this year, 16 response plans got 80% of the funding last year.

Furthermore, the huge proportion of funding to the Ukraine and Afghanistan crises specifically tend to suggest a potential reallocation of funding. This could be a reallocation in both timing (front-loading to start of the year to respond to immediate needs), and a reallocation in where funding goes (consolidation of funding into a smaller number of contexts).

Therefore, whilst our forecasts have increased due to the mechanics of our model, we might see the forecasts reduce again later in the year if the higher equilibrium hypothesis is wrong, and the reallocation hypothesis is correct.

Methodology and Sources

Head over to our Forecast Methodology page for more technical information on how our forecasts work.